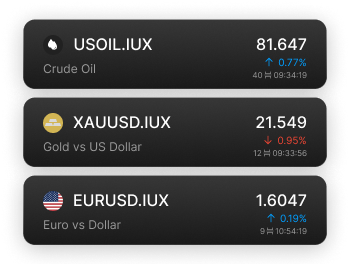

Spreads from 0.0 Pips

A better world-class spread offerings

Trade with spreads starting from 0.0 pips

A diverse proprietary liquidity mix ensures tight spreads 24/7

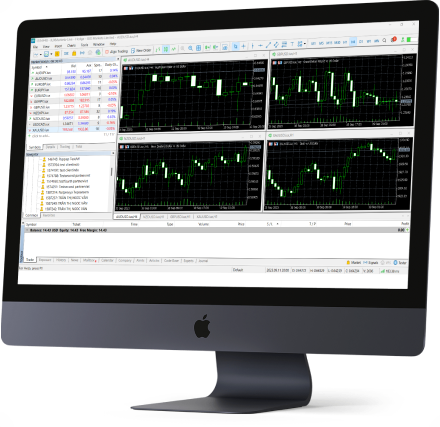

Institutional-Grade Trading

Reduced slippage for seamless transactions

Institutional-grade trading with real, deep liquidity

Over 1.5 billion USD in CFD trades processed daily

Fast Order Execution

Average execution speeds are under 30 ms

Low-latency fiber optic and Equinix LD4 server

Ready to Get Started?

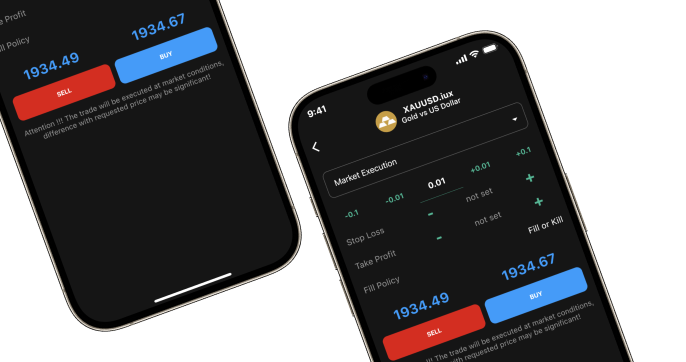

Accessible Analytics

View the market chart to stay up-to-date with the markets.

Popular Assets

View global markets by instrument for quick margin, spread, and swap calculations.

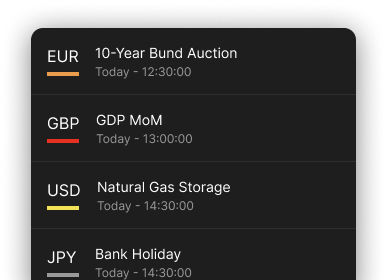

Economic Calendar

View the latest market news and upcoming economic events.

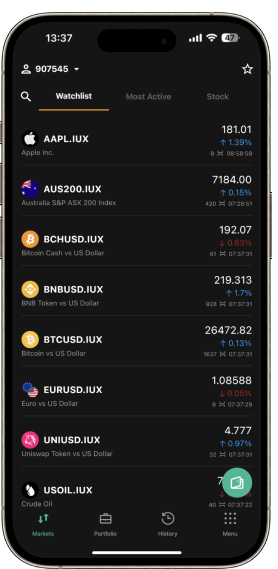

Global Markets at Your Fingertips

Currencies (CFD)

40+ products

Stocks (CFD)

70+ products

Indices (CFD)

10+ products

Crypto (CFD)

15+ products

Commodities (CFD)

10+ products

Thematic Indices (CFD)

6 products

Our Awards

Our dedication to innovation and client service has consistently earned us prestigious awards from leading financial publications. Join us and experience the best in the industry.